invoice management software for small business: top picks

Chasing payments and wrestling with spreadsheets is a major drain on any small business owner's time and energy. Manual invoicing is slow, prone to errors, and creates a significant delay between doing the work and getting paid. This lag can strain cash flow, hindering your ability to invest in growth, pay suppliers, or even cover daily operational costs.

The right invoice management software for small business transforms this process from a reactive chore into a proactive, automated system. It ensures professional, accurate invoices are sent on time, provides clients with easy payment options, and automatically follows up on overdue accounts. By centralizing this critical financial task, you not only accelerate your payment cycle but also gain invaluable insights into your business's financial health.

Smart invoice management is a cornerstone of effective small business cash flow management, providing essential tools to ensure your business stays financially healthy. This comprehensive guide moves beyond generic feature lists to provide an in-depth analysis of the top platforms available today, from dedicated invoicing tools to full-fledged accounting suites.

We'll dive deep into the 12 best tools designed to help you get paid faster, reduce administrative overhead, and take firm control of your revenue stream. Each review includes a detailed breakdown of features, pricing, and specific use cases, complete with screenshots and direct links to help you make an informed decision. This resource is designed to help you find the perfect fit, whether you're a freelancer, a growing agency, or a service-based business ready to streamline your finances.

1. Intuit QuickBooks Online

Intuit QuickBooks Online is a comprehensive accounting platform that excels as an invoice management software for small business due to its deep integration of invoicing, payments, and bookkeeping. It’s best suited for businesses seeking an all-in-one solution where financial data flows seamlessly from invoice creation to reconciliation. Unlike standalone invoicing tools, QuickBooks ties every invoice directly to your general ledger, providing real-time financial health insights.

The platform allows users to create and send professional, customizable invoices, set up recurring billing for retainer clients, and automate payment reminders to reduce late payments. With QuickBooks Payments activated, you can accept credit card and ACH payments directly from the invoice, which significantly streamlines cash flow and automatically marks invoices as paid, saving hours of manual reconciliation.

Key Features and Pricing

The user interface is clean and, while feature-rich, is generally intuitive for those with basic accounting knowledge. For businesses looking to integrate their project management and invoicing, some users have found success connecting QuickBooks with other platforms, and you can explore methods for streamlining client communication to further enhance your workflow.

- Pricing: Plans range from Simple Start ($30/month) to Advanced ($200/month), with invoicing available on all tiers. QuickBooks Payments processing fees are additional.

- Best For: Service-based businesses, freelancers, and growing SMBs that need a unified accounting and invoicing system.

- Unique Offering: Its main advantage is the powerful ecosystem. The software is nearly ubiquitous among accountants, and its vast library of third-party app integrations makes it a central hub for business operations.

| Pros | Cons |

|---|---|

| Deep accounting and payments in one system | Pricing has increased in 2024-2025 |

| Scales from solo users to larger SMBs | Payment processing fees can be high for some |

| Ubiquitous with accountants and third-party apps | Can be more complex than needed for simple invoicing |

Learn more at quickbooks.intuit.com/online

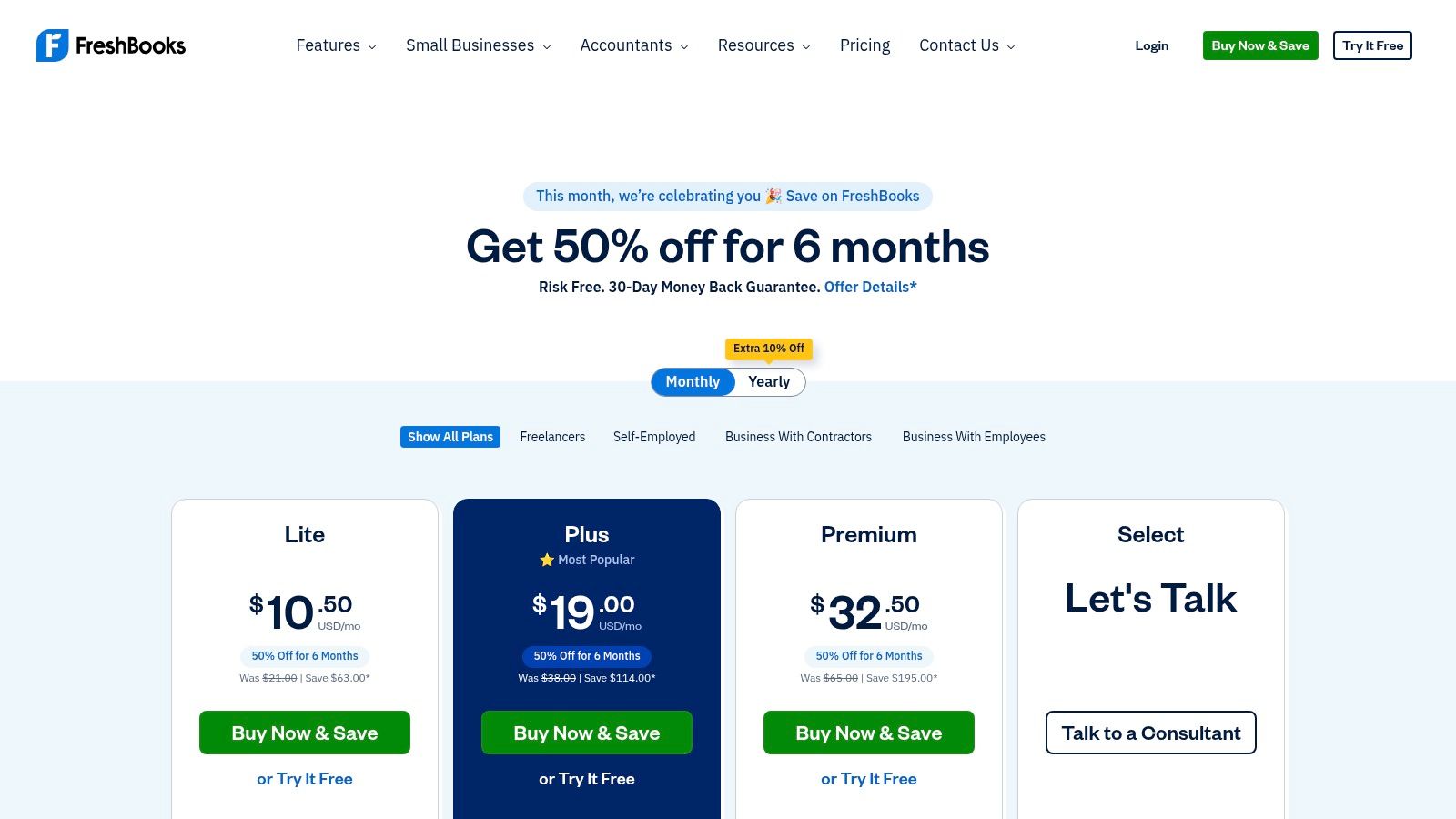

2. FreshBooks

FreshBooks is renowned for its user-friendly interface, positioning itself as an ideal invoice management software for small business, particularly for freelancers and service-based entrepreneurs. Its core strength lies in simplifying the entire client workflow from proposal to payment. Unlike more complex accounting systems, FreshBooks prioritizes ease of use and speed, allowing users to create professional-looking invoices, track billable time, and manage project expenses with minimal friction.

The platform shines in its ability to convert estimates and proposals into invoices with a single click, automating a significant part of the sales cycle. You can set up recurring invoices for retainers, send automated payment reminders, and accept online payments through FreshBooks Payments, Stripe, or PayPal. This tight integration of project management, time tracking, and invoicing makes it a powerful tool for businesses that bill by the hour or by the project.

Key Features and Pricing

The user experience is exceptionally intuitive, with a clean dashboard and a highly-rated mobile app that allows for invoicing and expense tracking on the go. Its approachability makes it a great starting point for business owners who find traditional accounting software intimidating.

- Pricing: Plans start with Lite ($19/month for 5 billable clients), move to Plus ($33/month for 50 clients), and Premium ($60/month for unlimited clients). Payment processing fees are separate.

- Best For: Freelancers, consultants, and creative agencies that need strong time tracking and project-based billing capabilities.

- Unique Offering: Its standout feature is the seamless integration of client-facing documents. Users can manage proposals, estimates, retainers, and invoices all within a single, cohesive workflow designed around client service.

| Pros | Cons |

|---|---|

| Very approachable UI and mobile app | Lite and Plus plans cap the number of billable clients |

| Solid project and time tracking integrated with billing | Add-on fees for additional team members can add up |

| Excellent for managing the entire client lifecycle | Not as feature-rich in pure accounting as competitors |

Learn more at freshbooks.com/pricing

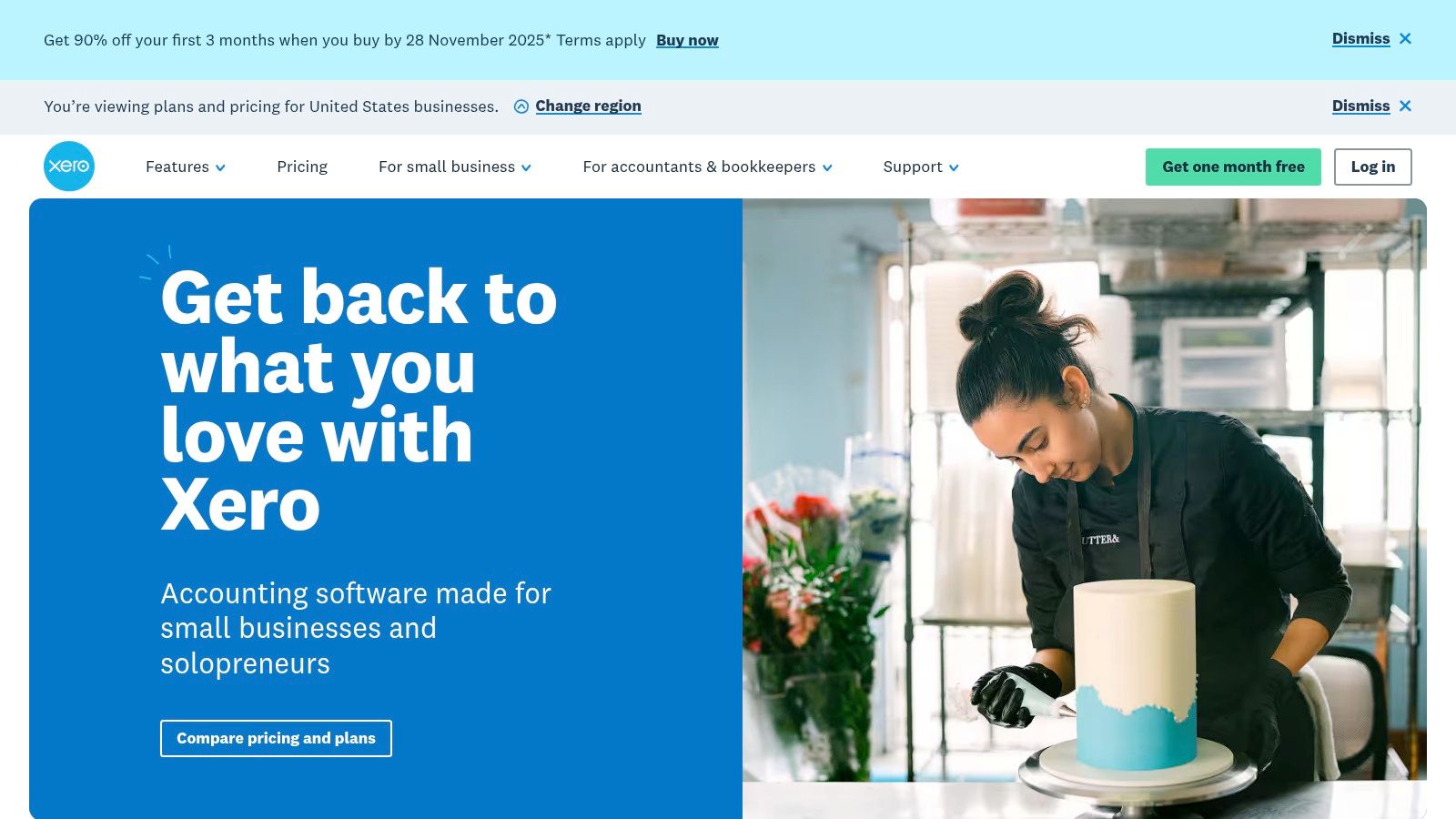

3. Xero

Xero stands out as a powerful cloud-based invoice management software for small business that blends user-friendly design with robust accounting features. It’s an excellent alternative for growing SMBs, particularly those operating internationally, as it offers strong multi-currency support. Unlike some competitors that keep invoicing basic, Xero provides a sophisticated invoicing experience with deep integrations into its broader accounting ecosystem, ensuring a smooth transition from quote to payment reconciliation.

The platform empowers users to create and send professional invoices from a web browser or mobile app, complete with a "Pay now" button linked to providers like Stripe and GoCardless. Automated reminders and real-time invoice status tracking help accelerate payment cycles and reduce administrative overhead. For businesses managing multiple communication channels, integrating tools can be key, and you can explore methods for saving email communications to keep your records organized alongside your financial data.

Key Features and Pricing

Xero’s user interface is generally clean and modern, although the transition to its new invoicing experience (introduced in 2025) may require a short adjustment period for long-time users. The platform's strength lies in its reliable bank feeds and a well-developed app marketplace that extends its core functionality significantly.

- Pricing: Plans start with Early ($15/month, limited invoices), grow to Growing ($42/month), and top out at Established ($78/month).

- Best For: Growing SMBs, e-commerce businesses, and companies that require strong multi-currency invoicing capabilities.

- Unique Offering: Its seamless integration with a wide range of payment gateways and third-party apps, combined with a focus on a clean user experience, makes it a top choice for modern businesses.

| Pros | Cons |

|---|---|

| Strong multi-currency support and integrations | Some features are limited in the entry-level plan |

| Good ecosystem and reliable bank feeds | Occasional UI transitions may affect workflows |

| Useful analytics and forecasting in higher plans | Feature changes require confirming niche feature support |

Learn more at xero.com/us

4. Zoho Invoice

Zoho Invoice stands out as a powerful and completely free invoice management software for small business, making it an unbeatable option for freelancers, startups, and budget-conscious entrepreneurs. Its primary value proposition is offering a full suite of professional invoicing features at no cost, which is a rare find in the market. Unlike freemium plans with severe limitations, Zoho Invoice allows for unlimited invoices, clients, and projects without a monthly subscription fee.

The platform supports creating professional estimates and converting them to invoices with one click, setting up recurring billing, and sending automated payment reminders to ensure steady cash flow. It also includes a secure client portal where customers can view their invoice history, make payments, and approve estimates. This self-service feature enhances the client experience and reduces administrative back-and-forth for the business owner.

Key Features and Pricing

The user interface is clean and straightforward, making it easy to navigate and set up even for those without accounting experience. Its deep integration with the wider Zoho ecosystem means that as your business grows, you can seamlessly add CRM, Books, or Projects to create a unified operational hub, starting from a solid, free invoicing foundation.

- Pricing: The entire platform is 100% free for a single user. Transaction fees from integrated payment gateways (like Stripe or PayPal) still apply.

- Best For: Freelancers, consultants, and new small businesses that need robust, professional invoicing tools without a monthly software cost.

- Unique Offering: Its "forever free" model is its biggest differentiator. It delivers premium features like time tracking, expense management, and a client portal, which are typically found only in the paid tiers of competing software.

| Pros | Cons |

|---|---|

| Completely free for unlimited invoices and clients | Fewer third-party integrations than larger rivals |

| Integrates seamlessly with the wider Zoho suite | Payment processors’ transaction fees still apply |

| Includes advanced features like a client portal | The free plan is limited to a single user |

Learn more at zoho.com/us/invoice

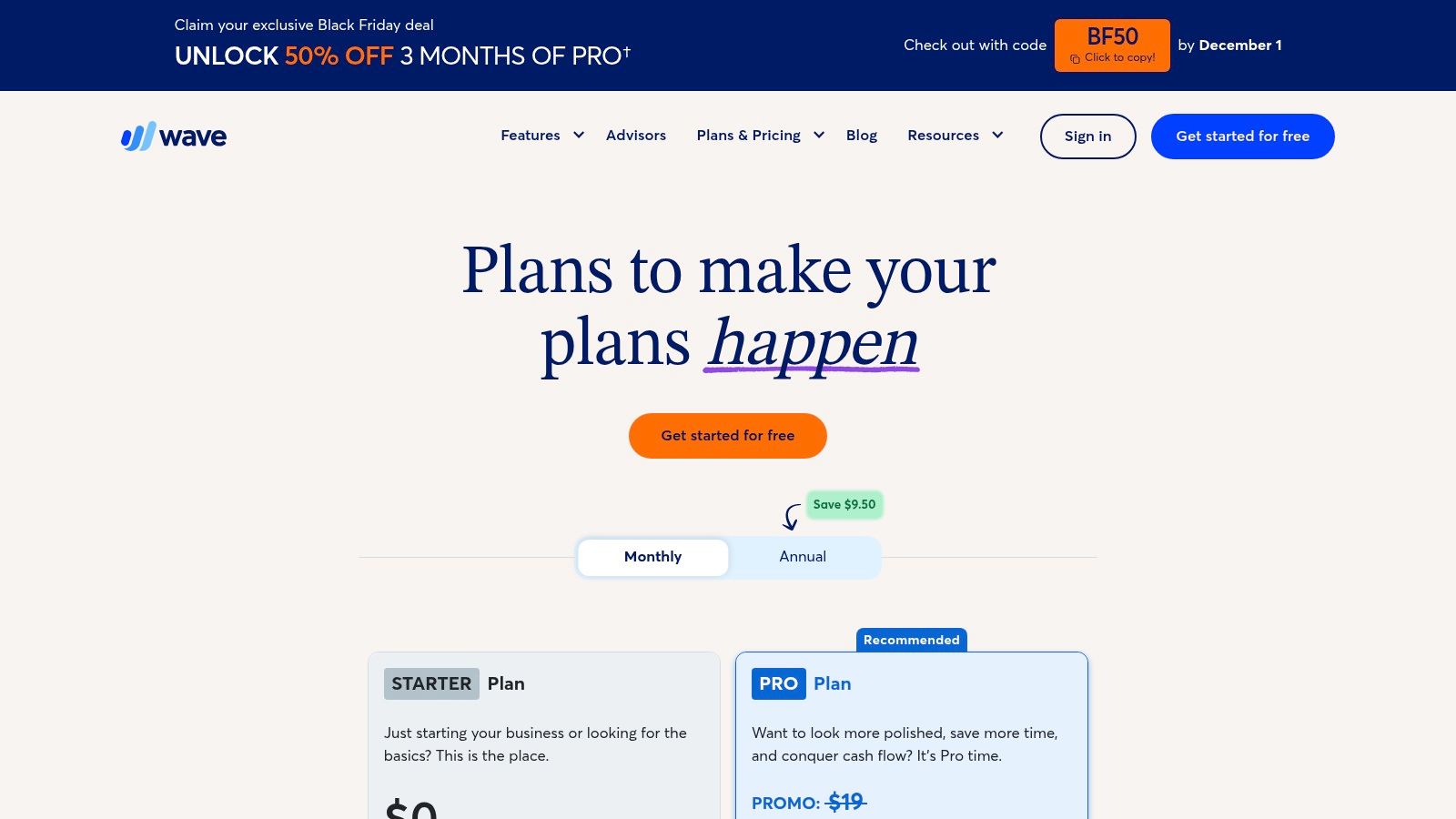

5. Wave

Wave stands out as an exceptional invoice management software for small business, particularly for freelancers, solopreneurs, and microbusinesses, by offering its core invoicing and accounting services for free. This approach removes the barrier of monthly subscription fees, making it the ideal starting point for new ventures. Unlike many competitors, Wave’s free tier is not a limited trial; it provides unlimited, professional invoicing capabilities without a financial commitment.

The platform enables users to create and send customized invoices and estimates from a desktop or mobile app. It also supports automated recurring invoices for ongoing client work and sends payment reminders to help minimize late payments. You can accept online credit card and bank payments directly through the invoices, with transactions automatically recorded in the integrated accounting software, simplifying bookkeeping and tax preparation.

Key Features and Pricing

Wave's user interface is clean and designed for individuals without an accounting background, making it incredibly straightforward to get started. While the core functionality is free, the business model is built on optional, paid add-ons and payment processing fees, allowing the platform to scale with your business's needs.

- Pricing: The Starter plan (Invoicing & Accounting) is free. The Pro plan ($16/month) adds features like auto-importing bank transactions. Optional payroll and advisory services are available for additional fees.

- Best For: Freelancers, consultants, and side hustles needing professional invoicing and basic bookkeeping without any upfront cost.

- Unique Offering: Its no-cost, unlimited invoicing and accounting solution is its primary differentiator. It provides a robust, professional-grade system for free that is sufficient for many small-scale operations.

| Pros | Cons |

|---|---|

| No-cost entry to professional invoicing | Advanced automation requires a paid plan |

| Simple user interface for small operations | Payment processing fees apply for online payments |

| Clear upgrade path to add payroll or bookkeeping | Customer support is more limited on the free tier |

Learn more at waveapps.com/pricing

6. Square Invoices

Square Invoices provides a powerful solution for businesses already embedded in the Square ecosystem or those needing a simple, effective way to bill clients. It stands out as an invoice management software for small business, especially for service providers and field professionals, by tightly integrating invoicing with its renowned payment processing and POS systems. This connection allows for a frictionless experience from sending an estimate to getting paid, all within one familiar platform.

The platform enables users to send unlimited invoices, estimates, and contracts even on its free plan. It supports diverse payment methods including cards, ACH bank transfers, Apple Pay, Google Pay, and even Afterpay, giving clients ultimate flexibility. Real-time tracking and automated reminders sent via email or SMS help accelerate payment cycles and reduce administrative follow-up.

Key Features and Pricing

The user interface is exceptionally straightforward, making it one of the easiest platforms to set up and use immediately. For businesses requiring more advanced capabilities, the Plus plan unlocks features like custom fields for detailed invoices, milestone-based payment schedules for projects, and the ability to send batch invoices to multiple customers at once.

- Pricing: A Free plan is available with standard processing fees. The Plus plan is $20/month (plus processing fees) and adds advanced features and lower capped ACH transaction fees.

- Best For: Service providers, contractors, freelancers, and any business using Square POS for in-person sales.

- Unique Offering: Its seamless integration with the full suite of Square tools, including POS, appointments, and marketing, makes it a unified commerce solution. The free-to-start model is a major draw for new businesses.

| Pros | Cons |

|---|---|

| Simple setup and no monthly fee to start | Advanced customization requires the Plus plan |

| Integrated with Square POS and payments | Feature depth may lag dedicated accounting platforms |

| Competitive ACH pricing with fee caps on Plus | Reporting is less robust than full accounting software |

Learn more at squareup.com/us/en/invoices

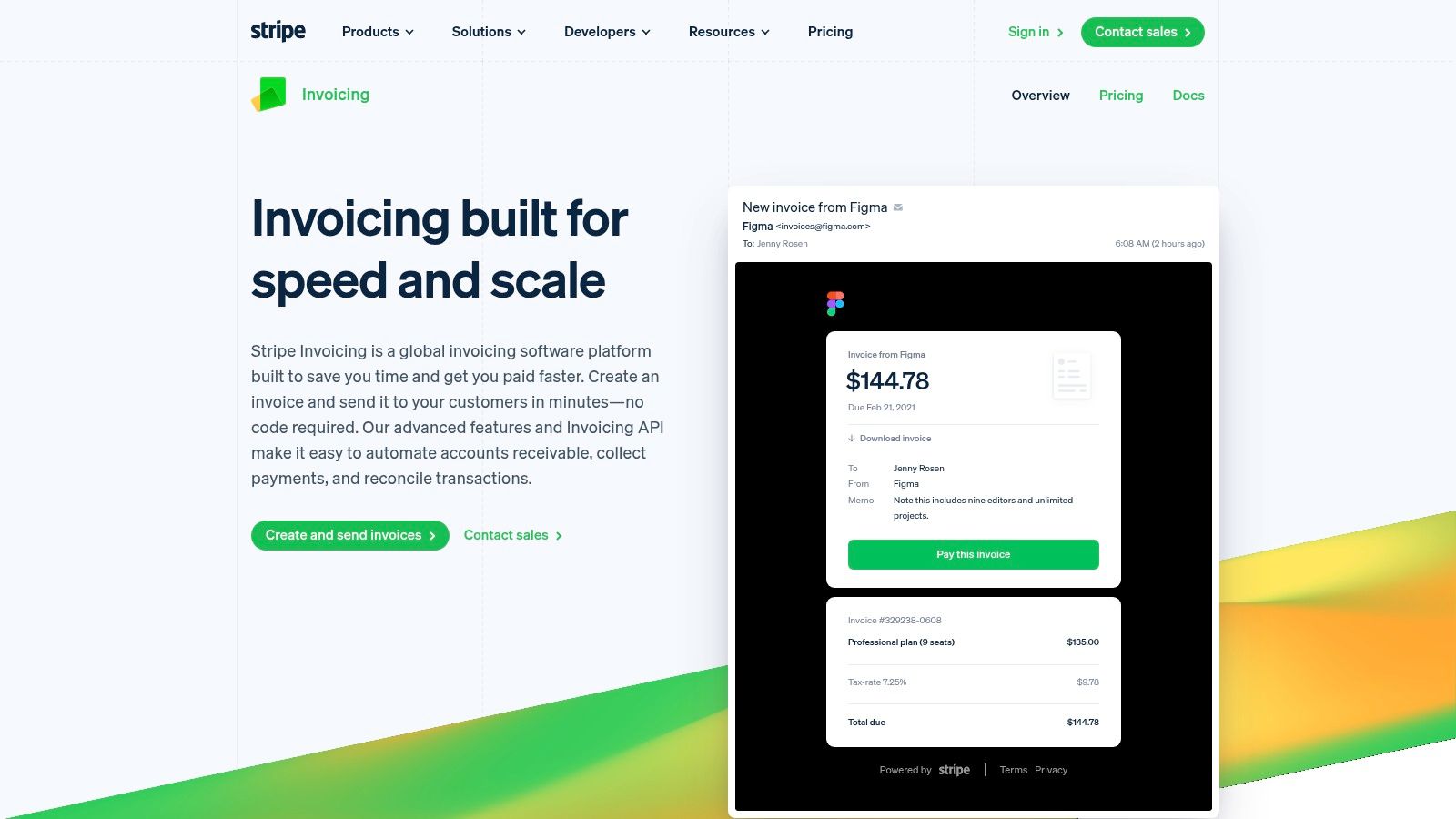

7. Stripe Invoicing

Stripe Invoicing is a payment-first platform that excels as an invoice management software for small business, especially for companies already embedded in the Stripe ecosystem. It is best suited for businesses that prioritize a seamless, fast payment experience for their customers and need robust automation capabilities. Unlike traditional accounting software, Stripe’s focus is on streamlining the accounts receivable process with powerful developer tools and global payment acceptance.

The platform enables users to create and send professional invoices from a hosted URL, reducing friction and encouraging quick payments. Key features include automated dunning to chase late payments, recurring billing schedules, and aging reports to monitor outstanding revenue. Because it’s built on Stripe Payments, it supports a vast array of global currencies and payment methods, making it ideal for businesses with an international client base.

Key Features and Pricing

The user interface is modern and developer-friendly, with an API that allows for deep customization of AR workflows. When considering Stripe Invoicing, it's also wise to investigate options like Stripe Chargeback Protection to safeguard your earnings. To further improve your process, you can also learn about integrating your email communications for a more cohesive client management system.

- Pricing: The Invoicing Starter plan is free, charging 0.4% per paid invoice. The Invoicing Plus plan is $25/month plus 0.5% per paid invoice. Standard Stripe payment processing fees apply to both.

- Best For: Tech-savvy businesses, SaaS companies, and developers needing a highly customizable and automated invoicing solution.

- Unique Offering: Its API-first approach is its greatest strength, allowing businesses to build completely custom, scalable invoicing and dunning workflows that integrate directly into their products or services.

| Pros | Cons |

|---|---|

| Excellent developer tools and automation capabilities | Separate Stripe processing fees plus per-paid-invoice fees |

| Strong international coverage and payment method variety | Requires developer/integration effort for custom workflows |

| Fast payer experience that drives high invoice pay rates | Lacks the deep accounting features of an all-in-one system |

Learn more at stripe.com/us/invoicing

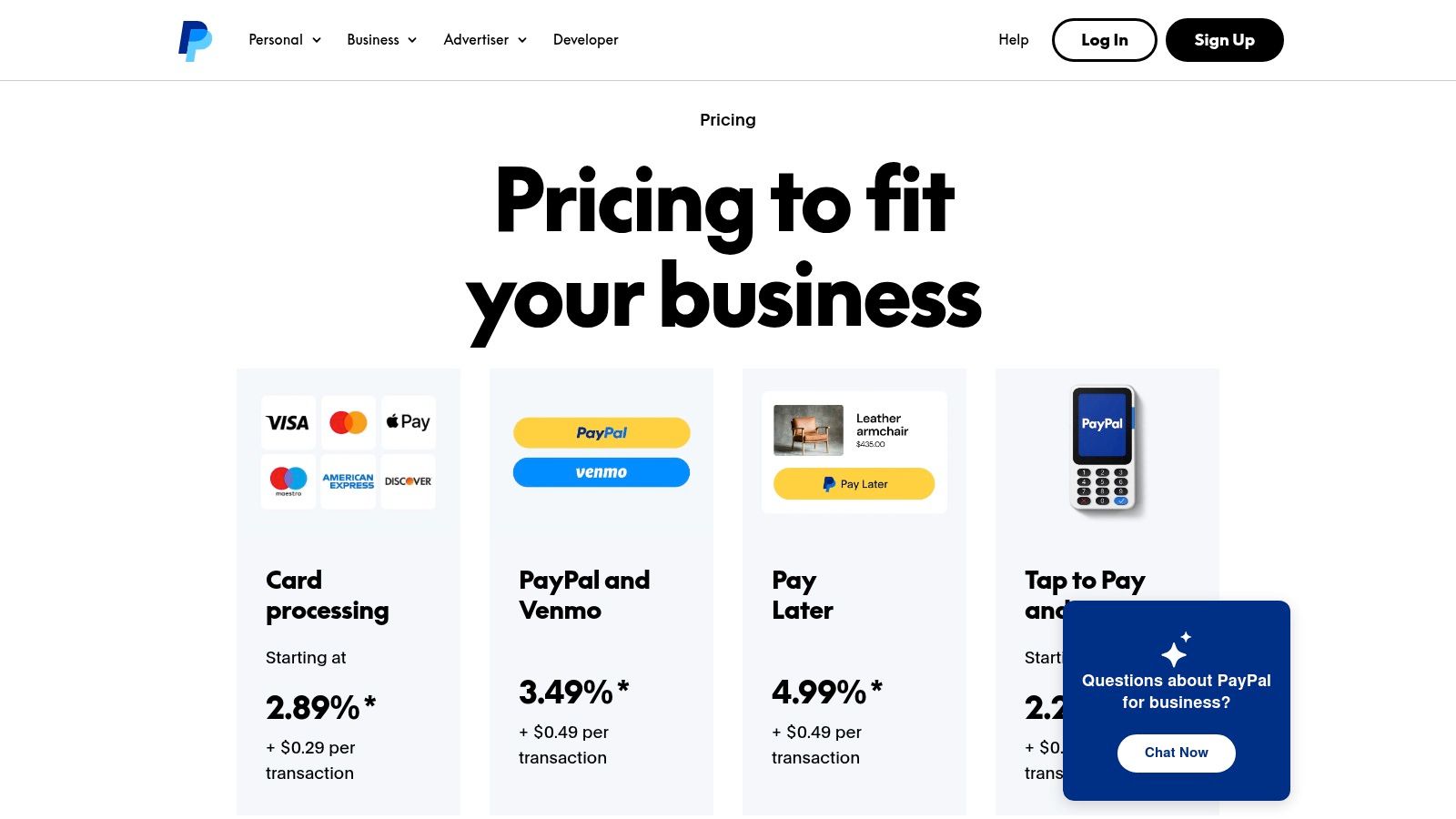

8. PayPal Invoicing

PayPal Invoicing leverages a globally recognized payment network to offer straightforward invoice management software for small business owners. It is an ideal solution for freelancers, solopreneurs, and businesses that already use PayPal for transactions or deal with international clients. Its strength lies in its simplicity and the trust consumers place in the PayPal brand, which can lead to faster payments and a frictionless checkout experience for customers.

The platform allows you to create and send invoices directly from your PayPal Business account via web or mobile app. Clients can pay instantly using their PayPal or Venmo balance, credit/debit cards, or even Apple Pay, with funds typically appearing in your account within minutes. While it lacks the deep accounting features of a full bookkeeping suite, it provides essential tools like basic invoice tracking, automated payment reminders, and options for recurring billing.

Key Features and Pricing

The user experience is incredibly simple, making it accessible for those who need a quick, no-frills invoicing method without the complexity of a dedicated accounting system. The mobile app is particularly useful for sending invoices on the go, right after a job is completed.

- Pricing: Free to create and send invoices. Transaction fees apply when you get paid, starting at 2.99% + fixed fee for standard card payments.

- Best For: Freelancers, international sellers, and businesses whose customers prefer paying with PayPal or Venmo.

- Unique Offering: The platform’s main advantage is its massive consumer reach and the familiar, trusted payment experience it provides, which can significantly reduce payment friction for consumer-facing services.

| Pros | Cons |

|---|---|

| Massive consumer reach and familiar payer experience | Fees on transactions can be higher than some ACH options |

| Quick to start and commonly used for occasional invoices | Limited deep accounting features compared to full platforms |

| Good for international or consumer‑facing billing | Lacks advanced customization and project management tools |

Learn more at paypal.com/us/business/pricing

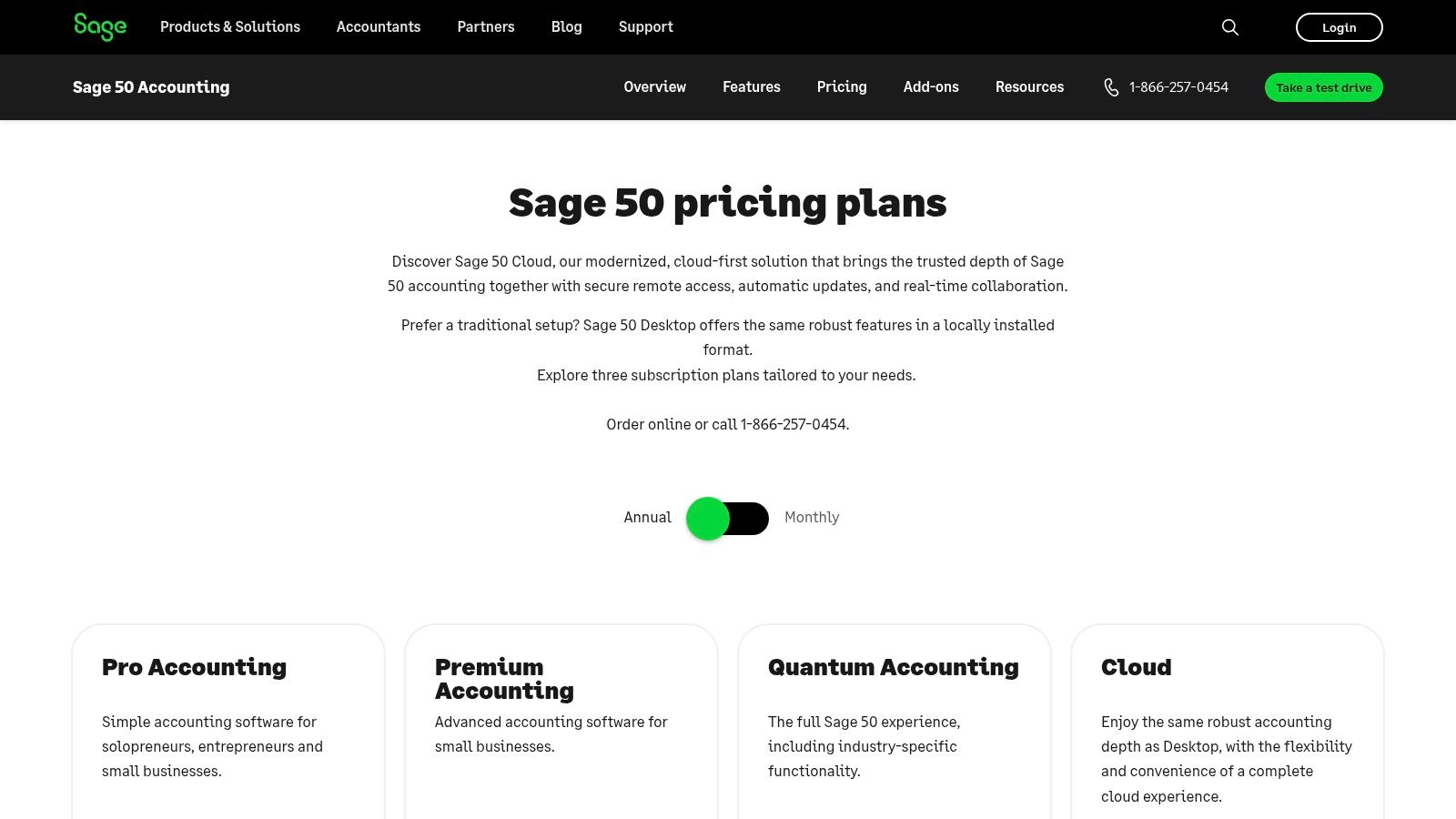

9. Sage 50 Accounting (US)

Sage 50 Accounting offers a desktop-class accounting experience modernized with cloud connectivity, making it a powerful invoice management software for small business, especially those with complex inventory or job costing needs. It is best suited for established businesses that require deeper financial controls and robust reporting beyond simple invoicing. Unlike purely cloud-based tools, Sage 50 provides the stability of a local installation with the flexibility of cloud data access and backups.

The platform supports comprehensive invoice and bill tracking, integrates purchase orders with approval workflows, and handles detailed bank reconciliation. Its strength lies in managing the entire financial cycle for product-based businesses, from procurement to sales. By adding Sage Invoice Payments, users can accept Stripe or PayPal payments directly, helping to accelerate cash collection and automate the reconciliation process within its mature accounting framework.

Key Features and Pricing

The user interface feels more traditional than modern SaaS platforms, reflecting its deep, feature-rich nature which may require a learning curve for newcomers. However, the included support and learning resources are valuable for navigating its extensive capabilities.

- Pricing: Annual subscriptions start with Pro Accounting at $619/year, with Premium and Quantum tiers offering more advanced features for growing businesses.

- Best For: Product-based businesses, construction, and distributors needing strong inventory management, job costing, and financial controls.

- Unique Offering: Its hybrid desktop-cloud model provides speed and reliability, while its advanced inventory and reporting features offer a level of detail that many cloud-only competitors lack.

| Pros | Cons |

|---|---|

| Mature feature set for inventory and product businesses | Higher annual pricing compared with cloud-only invoicing apps |

| Local install with cloud-connected capabilities for reliability | Heavier and more complex than pure invoicing tools |

| Robust reporting and deep accounting controls | User interface is less modern than SaaS alternatives |

Learn more at sage.com/en-us/products/sage-50/pricing

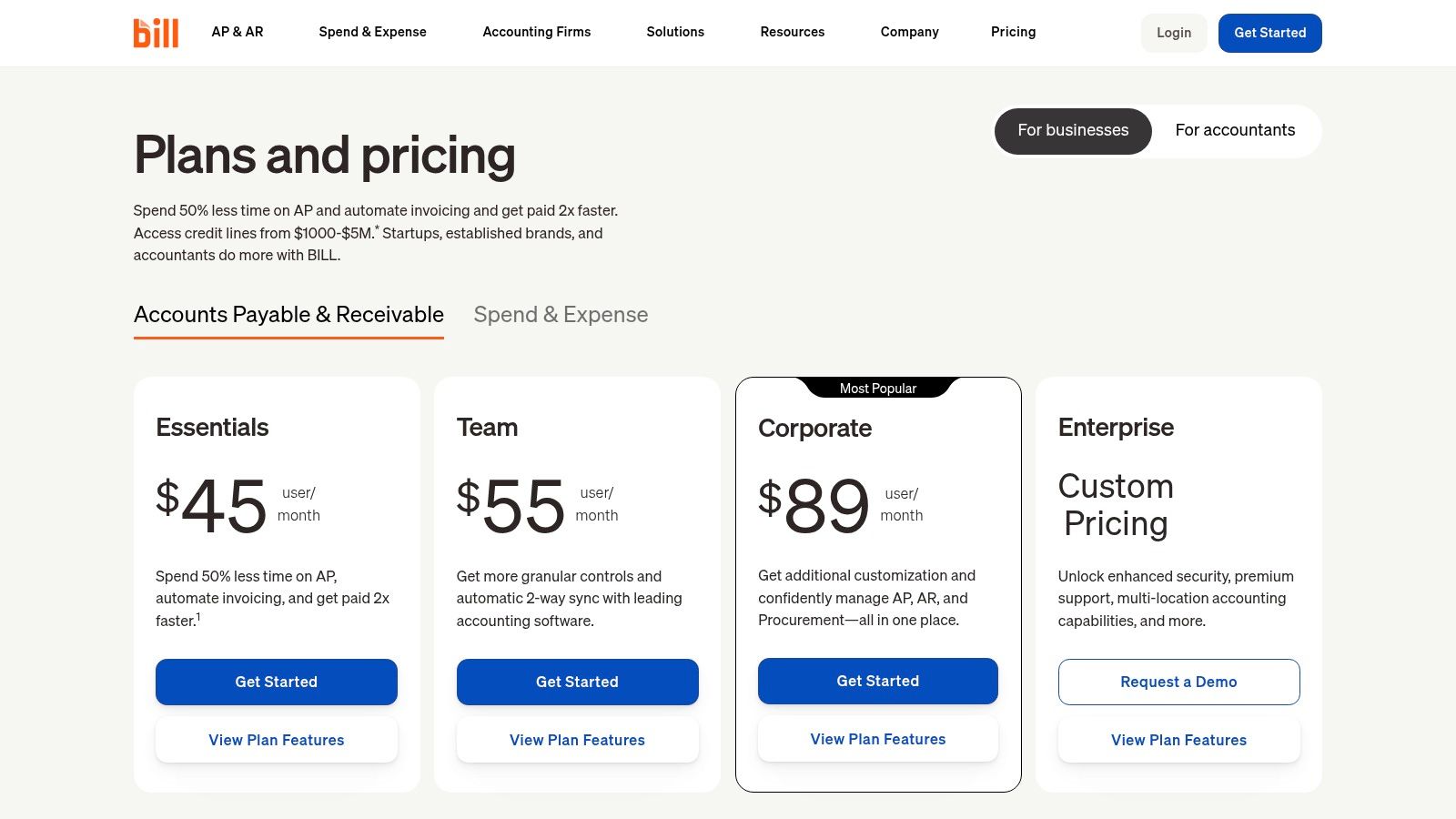

10. BILL (bill.com)

BILL is a powerful accounts payable (AP) and accounts receivable (AR) automation platform, making it an advanced invoice management software for small business geared toward control and scale. It excels in managing higher volumes of invoices and payments where process controls, like approvals, are critical. Unlike simpler invoicing tools, BILL is built to be a central hub for all money movement, both incoming and outgoing, providing a comprehensive view of cash flow.

The platform automates the entire AR lifecycle, from creating custom invoices and setting up recurring billing to sending automated payment reminders. For clients, it offers flexible payment options like ACH and credit cards through a secure portal. Its unique network feature can expedite payments if your customers are also on BILL, streamlining the collection process significantly.

Key Features and Pricing

The user interface is designed for finance teams, offering role-based access and clear audit trails for every transaction. Setup can be more involved than basic tools, but the payoff is a highly controlled and automated workflow. Its two-way sync with major accounting software like QuickBooks and Xero ensures that all financial data remains consistent without manual entry.

- Pricing: AR plans start at $45 per user/month, with more advanced features and AP automation available in higher-tier plans.

- Best For: Growing SMBs that need to automate both AR and AP with strong internal controls and approval workflows.

- Unique Offering: The platform's main strength is its end-to-end automation of both receivables and payables, combined with a vast payment network that can significantly reduce friction and payment delays.

| Pros | Cons |

|---|---|

| Strong workflow controls and scalability | Pricier than basic invoicing-only tools |

| Large vendor/customer network reduces friction | Configuration and setup can take time |

| End-to-end AP/AR automation for growing businesses | May be overly complex for simple invoicing needs |

Learn more at bill.com/product/pricing

11. Invoice2go

Invoice2go is a mobile-first invoice management software for small business designed for tradespeople and field service professionals who operate on the go. Its core strength lies in its simplicity and powerful mobile apps, allowing users to create, send, and manage invoices and estimates directly from a job site. Unlike desktop-centric accounting platforms, Invoice2go prioritizes speed and accessibility from a smartphone, ensuring that billing can happen the moment work is completed.

The platform enables users to create professional invoices, track time, and manage expenses from anywhere. It supports online payments through Stripe and PayPal, and on higher tiers, it offers lower transaction fees and free ACH bank transfers. This immediate invoicing and payment collection capability is crucial for businesses that don't operate from a traditional office, helping to dramatically improve cash flow and reduce the time between job completion and payment.

Key Features and Pricing

The user interface is exceptionally clean and purpose-built for mobile, making it easy for non-accountants to generate professional documents quickly. The optional Invoice2go Money feature adds a business bank account, further streamlining access to funds by depositing payments directly into the account.

- Pricing: Plans range from Starter ($5.99/month) to Unlimited ($39.99/month), with features like recurring invoices and lower payment fees reserved for higher tiers.

- Best For: Contractors, freelancers, and field service businesses that need a robust, mobile-native invoicing solution.

- Unique Offering: Its dedicated focus on the on-the-go billing experience is unmatched. The combination of an intuitive mobile app and integrated banking (Invoice2go Money) makes it a powerful tool for service professionals who need to manage their finances from the field.

| Pros | Cons |

|---|---|

| Excellent mobile apps tailored for field billing | Advanced accounting features are limited |

| Simple tiering with usage-based fee reductions | Some features on the pricing page are still “coming soon” |

| Optional integrated business banking speeds cash flow | Lacks deep project management or inventory tools |

Learn more at invoice.2go.com

12. Capterra

Capterra is a leading software marketplace, not a direct vendor, but it serves as an invaluable research tool for finding the right invoice management software for small business. It aggregates hundreds of invoicing and billing solutions, allowing you to compare features, read verified user reviews, and create shortlists based on your specific needs. This approach is best for business owners in the discovery phase who want to survey the market before committing to a single platform.

The platform provides detailed product pages with screenshots, feature lists, pricing snapshots, and direct links to official vendor websites and free trials. Its powerful filters let you narrow down options by business size, required features like recurring billing or payment reminders, and pricing models. This saves countless hours that would otherwise be spent visiting individual software sites to gather the same information.

Key Features and Pricing

The user experience is centered around efficient comparison, with standardized layouts for each software listing making it easy to see how different tools stack up. The verified reviews are particularly useful, offering honest feedback from real users about implementation challenges and standout features.

- Pricing: Free to use for research and comparison. Pricing for individual software tools must be verified on the respective vendor websites.

- Best For: Small business owners, freelancers, and managers who are starting their search for invoicing software and want to compare multiple options efficiently.

- Unique Offering: Its core value lies in its comprehensive, aggregated database of software combined with verified, real-world user reviews, which provides a level of unbiased insight you can't get from a vendor’s marketing page.

| Pros | Cons |

|---|---|

| Time-saver for comparing many tools quickly | Not a vendor; final details must be verified |

| Verified user reviews provide practical pros and cons | Marketplace listings may require follow-up |

| Free to use with direct links to vendor trials | The sheer number of options can feel overwhelming |

Learn more at capterra.com/billing-and-invoicing-software/s/small-businesses/

Top 12 Invoice Management Solutions for Small Business

| Product | Core features ✨ | Target audience 👥 | Strengths / USP 🏆 | Pricing / Value 💰 | Quality ★ |

|---|---|---|---|---|---|

| Intuit QuickBooks Online | Customizable invoices, native payments, mobile, integrations ✨ | SMBs, accountants 👥 | Widest ecosystem, reduces reconciliation 🏆 | Tiered plans; Payments fees apply 💰 | ★★★★☆ |

| FreshBooks | Invoicing, time & expense tracking, client communication ✨ | Freelancers & small teams 👥 | Very approachable UI, integrated project billing 🏆 | Tiered plans with client caps 💰 | ★★★★ |

| Xero | Cloud invoicing, “Pay now”, reminders, bank feeds ✨ | Growing SMBs, multi‑currency 👥 | Strong bank feeds & analytics 🏆 | Mid‑range plans; new invoicing UX 💰 | ★★★★ |

| Zoho Invoice | Unlimited invoices, client portal, automation ✨ | Startups & solo owners 👥 | Forever‑free starter, grows with Zoho suite 🏆 | Free core; paid integrations as needed 💰 | ★★★★ |

| Wave | Free invoicing & bookkeeping core, mobile app ✨ | Microbusinesses & side hustles 👥 | No‑cost entry, simple UX 🏆 | Free core; paid add‑ons for payroll/bookkeeping 💰 | ★★★★ |

| Square Invoices | Invoices + POS/payments, templates, reminders ✨ | Service providers, trades, retailers 👥 | Tight POS integration, easy setup 🏆 | Free start; Plus plan for advanced features 💰 | ★★★★ |

| Stripe Invoicing | Hosted invoices, API, recurring & dunning ✨ | Devs & scale‑oriented businesses 👥 | Best developer tools & global payments 🏆 | Transaction + per‑invoice fees; scalable 💰 | ★★★★★ |

| PayPal Invoicing | PayPal/Venmo/card payments, basic tracking ✨ | Consumer‑facing & occasional billers 👥 | Massive payer reach, very easy to start 🏆 | Pay‑per‑transaction fees; simple pricing 💰 | ★★★★ |

| Sage 50 Accounting (US) | Invoicing, inventory, POs, recon, reporting ✨ | Product‑based businesses, advanced accounting 👥 | Deep controls & reporting for inventory 🏆 | Higher annual cost vs cloud tools 💰 | ★★★★ |

| BILL (bill.com) | AP/AR automation, approvals, accounting sync ✨ | SMBs with high AR/AP volumes 👥 | Strong workflow controls & scalability 🏆 | Pricier; value for automation-heavy firms 💰 | ★★★★ |

| Invoice2go | Mobile‑first invoices, ACH/cards, optional banking ✨ | Field service & mobile businesses 👥 | Excellent mobile UX, business banking option 🏆 | Tiered plans; pay‑as‑you‑grow fees 💰 | ★★★★ |

| Capterra | Product shortlists, verified reviews, filters ✨ | Buyers researching software 👥 | Fast discovery, real reviews & vendor links 🏆 | Free marketplace; vendor pricing varies 💰 | ★★★★ |

Making the Right Choice for Your Business's Bottom Line

Navigating the landscape of invoice management software for small business can feel overwhelming, but this extensive exploration of top-tier tools should provide the clarity you need to make an informed decision. We've journeyed through comprehensive accounting powerhouses like QuickBooks and Xero, explored freelancer-focused platforms such as FreshBooks, and uncovered the value of free solutions like Wave. Each tool offers a unique blend of features, pricing structures, and ideal use cases, from the e-commerce integration strengths of Square and Stripe to the robust automation capabilities of BILL.

The central takeaway is that there is no single "best" platform for everyone. The right choice is deeply personal to your business's unique operational DNA. Your decision hinges on a careful evaluation of your specific needs, your existing tech stack, and your growth trajectory.

From Evaluation to Implementation: Your Actionable Next Steps

Making a confident choice requires moving from passive research to active testing. The most effective way to select the right invoice management software for your small business is to get hands-on experience and see how it performs in your real-world environment.

Here is a practical checklist to guide your final decision-making process:

-

Shortlist Your Top 3 Contenders: Based on our detailed breakdowns, select the three platforms that most closely align with your core requirements. If you're a service provider, your list might include FreshBooks, Zoho Invoice, and Wave. If you manage physical inventory, QuickBooks Online, Xero, and Sage 50 might be more appropriate.

-

Leverage Free Trials and Demos: Nearly every platform on our list offers a free trial or a free plan. This is your single most valuable evaluation tool. Use this period to perform your most common invoicing tasks: create a test invoice, set up a recurring payment schedule, connect your bank account, and run a basic report.

-

Assess Integration Capabilities: Your invoicing software doesn't operate in a vacuum. Critically assess how well your top choices connect with the other tools you rely on daily. This includes your CRM, project management software, payment gateways, and banking institutions. A tool that creates data silos will ultimately create more work, not less.

-

Evaluate the Client Experience: Send a test invoice to yourself or a colleague. How easy is it for a client to view the invoice, understand the charges, and complete the payment? A smooth, professional, and user-friendly client-side experience directly impacts how quickly you get paid.

-

Consider Your Future Needs: Don't just solve for today's problems. Think about where your business will be in one to three years. Will you need to add employees, manage more complex projects, or handle international currencies? Choose a platform that has a clear upgrade path and can scale alongside your ambitions.

Final Thoughts on Securing Your Financial Health

Ultimately, the goal of adopting any invoice management software for your small business is to reclaim your time and strengthen your cash flow. The right tool transforms invoicing from a tedious administrative chore into a streamlined, automated, and even insightful part of your business operations. It provides the financial clarity needed to make smarter decisions, chase bigger goals, and focus on the work that truly matters: serving your customers and growing your venture. By taking a strategic and hands-on approach to your selection process, you are making a critical investment in your company's long-term financial stability and success.

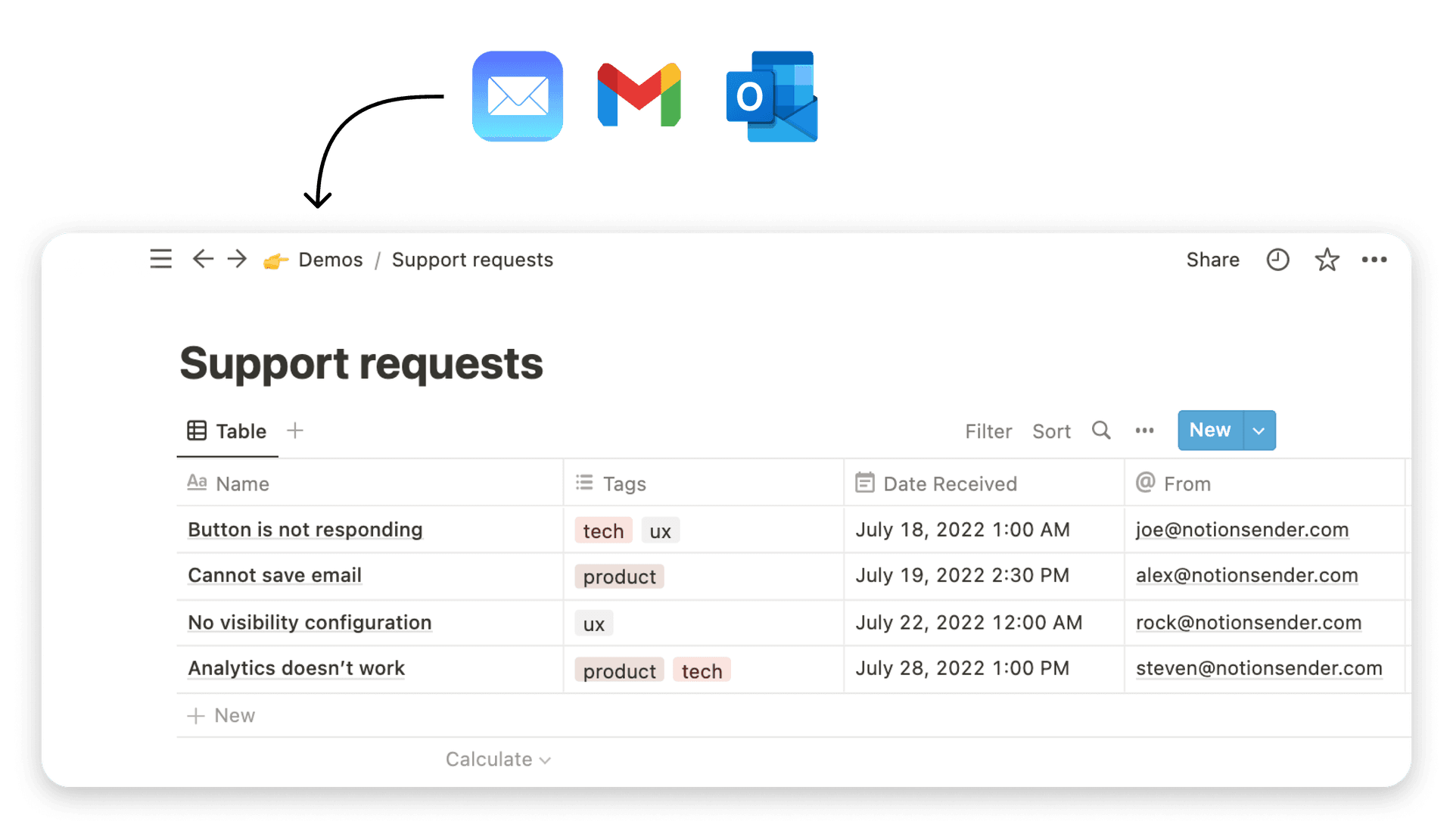

If your team's workflow is centered in Notion, you can bridge the gap between project management and billing without leaving your workspace. NotionSender allows you to manage and automate invoice communications directly from your Notion databases, creating a single source of truth for your projects and financials. Streamline your client outreach and get paid faster by visiting NotionSender to learn more.