Best Way to Organize Invoices: 7 Simple Steps for Peak Efficiency

Buried in a digital avalanche of PDFs and email threads? You're not alone. Disorganized invoices are more than just a nuisance; they're a drain on time, a risk to your cash flow, and a major source of stress. For freelancers, small businesses, and growing teams, finding an efficient system isn't a luxury. It's essential for survival and growth. But what is the best way to organize invoices when files are scattered and inboxes are overflowing?

The answer isn't a single magic bullet but a strategic combination of modern tools, smart processes, and clear principles. Forget the outdated, messy folder systems that create more work than they solve. This guide presents 10 powerful, actionable methods designed for today's dynamic work environment. You will find practical steps for building a system that works for you, not against you.

This article moves beyond basic tips and offers a concrete roadmap. We will explore specific strategies, including:

- Building a centralized database in a tool like Notion.

- Automating email capture with services such as NotionSender.

- Implementing intelligent data extraction to reduce manual entry.

- Creating project-based tracking for clear financial oversight.

Each method is broken down into manageable steps, showing you how to implement them immediately. Prepare to transform your invoice management from a dreaded chore into an orderly, automated, and insightful part of your business operations. Let's dive in.

1. Digital Database Organization with Notion

For those who already operate within the Notion ecosystem, creating a dedicated database is a powerful way to centralize invoice management. Instead of scattering files across different folders, this approach builds a single, interactive hub where every invoice is a structured data entry, not just a static file. This method transforms invoice tracking from a passive filing task into an active management system.

Small agencies find this particularly effective for linking invoices directly to their corresponding project timelines and client dashboards. Freelancers who manage their entire business in Notion can connect invoices to tasks, client contacts, and financial goals, creating a complete operational view. The best way to organize invoices with this method involves treating each one as an item in a dynamic, filterable, and sortable database.

Implementation Steps

To get started, create a new database in Notion and set up properties (columns) that are crucial for tracking. This creates a flexible foundation for your system.

- Essential Properties:

Invoice #,Client Name(Relation property),Amount,Issue Date,Due Date, andStatus. - Status Tags: Use a

Selectproperty for the status with color-coded options likeDraft,Sent,Paid,Overdue, andVoid. This provides immediate visual cues. - Calculated Fields: Add a

Formulaproperty to automatically calculate days overdue:if(prop("Status") == "Paid", 0, dateBetween(now(), prop("Due Date"), "days")). This helps prioritize follow-ups.

By creating different database views, you can instantly generate reports. For example, a "Requires Action" view can filter for all invoices with the status "Overdue" or "Due in 7 Days," turning your database into a proactive tool. To truly transform your digital invoice organization and overcome paperwork chaos, consider implementing a dedicated document management system.

This approach excels by keeping your financial records deeply integrated with your operational workspace. For more ideas on how to customize your workspace, explore these 10 tips for getting the most out of Notion.

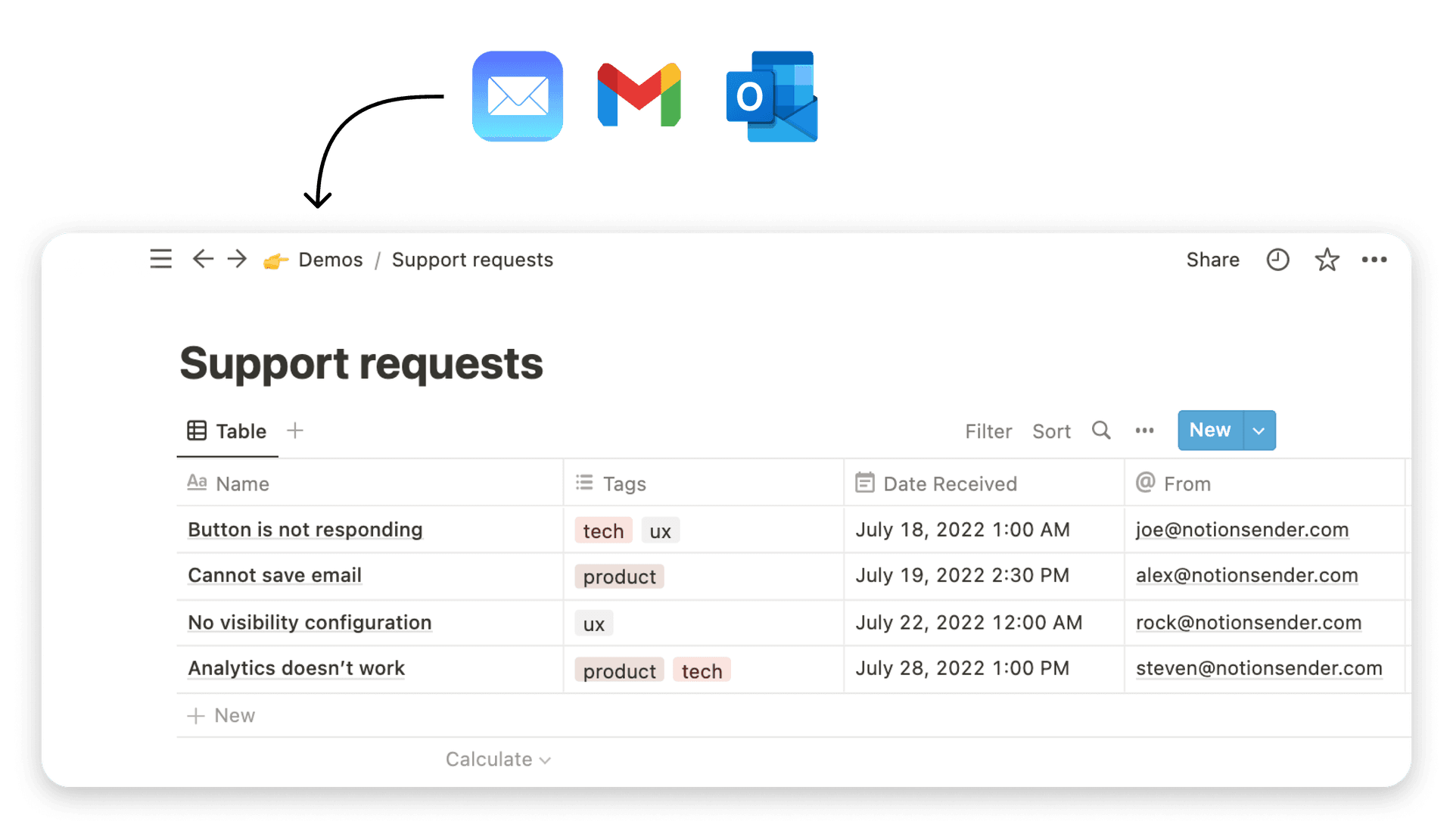

2. Email-to-Database Automation via NotionSender

Manually saving email attachments and copying invoice details is a significant time drain and a common source of error. An email-to-database workflow using a tool like NotionSender automates this entire process. This method provides each of your Notion databases with a unique email address, allowing you to forward invoices directly into your system where key data is automatically extracted and organized.

This approach is ideal for project managers who need to capture vendor invoices as they arrive or marketing agencies organizing billing documents from various clients without manual entry. Freelancers can also create an auto-forwarding rule in their email client to send all incoming invoices to their Notion workspace, ensuring nothing gets missed. The best way to organize invoices with this system is to let automation handle the tedious data capture, freeing you up to focus on analysis and follow-up.

Implementation Steps

Setting this up involves connecting your email to Notion via an intermediary service. This creates a direct pipeline for incoming financial documents.

- Generate a Unique Email: In NotionSender, connect your Notion workspace and create a "Sender" for your invoices database. This generates a unique email address tied directly to that database.

- Configure Mappings: Map the email subject, sender, and body content to corresponding properties in your Notion database, such as

Invoice #,Client Name, andAmount. - Set Up Auto-Forwarding: Create a filter in your email client (like Gmail or Outlook) to automatically forward emails containing invoices to your newly generated NotionSender address.

The real power comes from establishing rules that trigger actions based on invoice properties. For instance, an automation can be set up in Notion to send a Slack notification to your finance channel whenever a new invoice is added with a "High Priority" tag, making your response immediate.

This method eliminates the manual steps of downloading, renaming, and uploading files, ensuring your financial database is always current. To see exactly how to connect your accounts, discover more about how to send emails to Notion.

3. Chronological Filing System

The chronological filing system is a foundational, time-based method where invoices are sorted by their issue or payment date. Instead of grouping by client or project, this approach organizes documents into sequential folders, typically by month or quarter. This method turns your invoice archive into a clear timeline of financial activity, making it easy to locate documents when you know roughly when they were handled.

This approach is highly effective for solo freelancers and small businesses whose primary retrieval need is date-dependent, such as referencing a transaction from "last March" or pulling all invoices for a specific tax quarter. The simplicity of chronological filing makes it an excellent starting point for those building their first organizational system. The best way to organize invoices using this method is to establish a consistent, tiered folder structure that requires minimal daily maintenance.

Implementation Steps

To begin, decide on your primary time-based folders (e.g., yearly) and create subfolders for smaller periods. This creates a logical hierarchy that is easy to navigate.

- Create Tiered Folders: Start with a main "Invoices" folder. Inside, create folders for each year (e.g.,

2024,2025). Within each year, create monthly folders:01-January,02-February, etc. - Establish a Naming Convention: Use a clear and consistent file naming system that includes the date, such as

YYYY-MM-DD_[ClientName]_[Invoice#].pdf. This makes files sortable even within a folder. - Subdivide by Status: For added clarity, create

PaidandUnpaidsubfolders within each monthly folder. As you receive payments, simply move the invoice file fromUnpaidtoPaid.

A powerful hybrid approach combines chronological folders with digital tags. For instance, while files are stored in

Invoices/2024/09-September, you could use a spreadsheet or a Notion database to tag that same invoice with its project name and client, giving you the searchability of a database with the simplicity of a time-based archive. To take this a step further, you can automate invoice emails directly into Notion, ensuring no document gets lost in your inbox.

This system's strength lies in its straightforward logic, making it a reliable and easy-to-maintain method for tracking financial history over time.

4. Client-Based Organization Method

For businesses whose operations revolve around distinct client relationships, organizing invoices by client name offers a clear and intuitive structure. This approach files every invoice under a specific client or vendor, making it the central point of reference. Instead of searching by date or invoice number, you immediately navigate to the client's dedicated folder or database entry to see their complete financial history. This method provides a powerful, relationship-focused view of your accounts.

Design agencies managing multiple projects for a single client find this approach especially effective for tracking account health and billing cycles. Similarly, consulting firms can quickly access a client's entire invoice history to review past work, outstanding balances, and payment patterns. The best way to organize invoices using this system is to establish a master client directory, which serves as the foundation for all financial documentation.

Implementation Steps

To begin, create a primary folder for each client or a dedicated client database if you're using a tool like Notion. This ensures that every invoice has a designated home from the moment it's created.

- Standardized Naming: Create a master client list with standardized names (e.g., "Innovate Corp" instead of "Innovate," "Innovate Inc.," or "innovate corp"). This prevents duplicate folders and confusion.

- Hierarchical Folders: Structure your digital folders hierarchically:

Clients > [Client Name] > Invoices > [Year]. This keeps documents tidy and easy to find. - Database Relations: If using a system like Notion or Airtable, link each invoice entry to a master

Clientsdatabase. This allows you to add client-specific details like contact information, contract terms, and payment history in one place.

By centering your organization around clients, you can build powerful, client-specific dashboards. Filter to see a single client's total revenue, average payment time, and outstanding balances at a glance, transforming your invoice system into a client relationship management tool. This is a crucial step to improve your business's financial health.

This method excels in service-based industries where understanding the financial status of each client relationship is critical for business strategy and long-term planning.

5. Category and Status-Based Organization

Moving beyond a simple chronological or alphabetical system, organizing invoices by category and status provides a multi-dimensional view of your finances. This method involves assigning tags or properties to each invoice based on its type (e.g., expenses, revenue), its current state (e.g., unpaid, paid, overdue), and its origin (e.g., department, project). This creates a highly filterable system that offers deep financial insights at a glance.

This approach is invaluable for businesses that need to track financial activity across different operational areas. An agency, for instance, can organize invoices by client, project type, and payment status to quickly assess profitability per project. Similarly, a larger company can track expense invoices by department and approval status, making budget allocation and departmental spending reviews much more efficient. Finding the best way to organize invoices often means creating a system that reflects how your business actually operates.

Implementation Steps

To implement this system, you need a tool that supports tagging or properties, such as a spreadsheet or a database application like Notion. The key is to establish a consistent set of categories that everyone on your team understands and uses.

- Establish Key Categories: Define your primary organizational pillars. These might include

Type(Revenue, Expense),Department(Marketing, Sales, Operations),Project Name, andClient. - Define Statuses: Create a clear workflow for invoice statuses. Common statuses include

Pending Approval,Unpaid,Paid,Partially Paid,Overdue, andIn Dispute. - Use Multi-Select Properties: In tools like Notion, use

Multi-selectproperties to apply several tags at once. An invoice could be tagged as "Marketing," "Q4 Campaign," and "Expense" simultaneously for precise filtering.

A well-defined categorization guide is crucial for team-wide consistency. This document should clearly outline what each category and status means, preventing ambiguity and ensuring that everyone files invoices correctly.

This method gives you the power to generate detailed reports and gain a clearer understanding of your cash flow. You can also explore different ways to use Notion for email communication to further centralize your client interactions and follow-ups.

6. OCR and Smart Data Extraction

Manual data entry is a significant bottleneck in invoice management, consuming valuable time and introducing a high risk of human error. This is where Optical Character Recognition (OCR) and smart data extraction come in, automating the process of pulling key information directly from invoice documents. Instead of typing out every detail, this technology reads PDFs and images, identifies relevant data like vendor names, amounts, and dates, and populates it into a structured system.

Small businesses and freelancers use this method to eliminate tedious administrative tasks, freeing them up for more critical work. For instance, tools like NotionSender can automatically extract invoice details from forwarded emails and place them directly into a Notion database. Similarly, accounting software like QuickBooks and enterprise solutions like Docparser use OCR to make invoice processing faster and more accurate. This approach is the best way to organize invoices when dealing with a high volume of documents from various vendors.

Implementation Steps

To begin using OCR, select a tool that fits your workflow and configure it to recognize and process your incoming invoices. This setup turns a manual chore into an automated, background process.

- Select Your Tool: Choose a platform that integrates with your existing systems. NotionSender is ideal for Notion users, while tools like Rossum or Docparser offer standalone solutions.

- Establish a Workflow: Set up an automation where all incoming invoices, whether from a dedicated email or a scanned folder, are sent directly to the OCR processor.

- Review and Train: Initially, review the extracted data to ensure accuracy. Many systems use AI that learns from your corrections, improving its performance over time for specific vendor layouts.

- Store Originals: For auditing and verification purposes, always store the original PDF or image file alongside the extracted data.

By automating data extraction, you not only save countless hours but also create a highly reliable and searchable financial database. The key is to build a system where the machine handles the repetitive work, allowing you to focus on analysis and follow-up.

This method is particularly effective for businesses that need to scale their operations without increasing their administrative overhead. Watch the video below to see how a tool like NotionSender makes this process seamless.

<iframe width="560" height="315" src="https://www.youtube.com/embed/oFRND66LThk" frameborder="0" allow="accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture" allowfullscreen></iframe>

7. Payment Terms and Aging Analysis Tracking

Shifting the focus from simple filing to financial health, this method organizes invoices based on their lifecycle and payment status. Instead of just knowing where an invoice is, this approach prioritizes when it's due and how long it has been outstanding. It involves actively tracking payment terms and using aging reports to categorize invoices by how overdue they are, offering a clear view of accounts receivable and payable.

B2B companies managing numerous supplier invoices find this essential for maintaining good vendor relationships and managing cash flow. Finance teams rely on it for accurate accounts payable aging, while project-based businesses use it to monitor milestone payments against deliverables. The best way to organize invoices with this system is to create a dynamic dashboard that visualizes payment obligations and flags financial risks.

Implementation Steps

To adopt this system, you need a central place to track invoice data, whether it's a spreadsheet, a Notion database, or dedicated accounting software. The key is to capture the right data points and use them to build actionable reports.

- Key Data Points: Track

Invoice #,Vendor/Client,Amount,Issue Date,Due Date, andPayment Terms(e.g., Net 30, Net 60). - Aging Buckets: Create columns or views that automatically categorize invoices into aging buckets like

Current (0-30 days),31-60 days,61-90 days, and90+ days. - Automated Alerts: Set up conditional formatting to highlight overdue invoices in red or trigger automated email reminders for invoices approaching their due date.

An aging report is more than a list; it's a diagnostic tool for your business's financial health. By regularly reviewing which invoices are falling into older aging buckets, you can identify clients who are consistently late payers or internal bottlenecks in your payment approval process. To further enhance your ability to track payment terms and aging analysis, consider exploring dedicated payment tracking software solutions.

This method excels by turning a passive archive of invoices into an active cash flow management system, providing the foresight needed to maintain financial stability.

8. Expense vs. Revenue Separation

A foundational practice for clear financial tracking is to create distinct systems for money coming in and money going out. Instead of mixing accounts payable and accounts receivable in one master list, this approach establishes separate workflows and databases. This mirrors standard accounting principles and prevents costly mix-ups, ensuring your revenue isn't muddled with your expenses.

This method is crucial for accounting departments managing distinct AP and AR functions, as well as professional services firms that must track both client bills and vendor payments. An e-commerce business, for instance, can use this separation to clearly monitor invoices from suppliers (expenses) while managing invoices sent to wholesale customers (revenue). Adopting this structure is the best way to organize invoices for an accurate, real-time view of your company's cash flow.

Implementation Steps

To begin, you will create two parallel but separate organizational systems. This division is the core of the method, promoting clarity and specialized workflows for each invoice type.

- Create Dual Systems: Establish two distinct databases or folder structures: one for Accounts Payable (AP) and another for Accounts Receivable (AR). In a digital tool like Notion, this means two separate databases.

- Visual Differentiation: Use unique icons, cover images, or color-coding for each system. For example, make your AR database green (for money in) and your AP database red (for money out) for immediate recognition.

- Unified Master Records: While the invoice systems are separate, link them to a single, unified master database for your clients and vendors. This prevents duplicate contact information and centralizes relationship management.

- Distinct Workflows: Define and document separate approval chains and processing steps for each. An expense invoice might require manager approval, while a revenue invoice simply needs confirmation of being sent.

The real power of this separation comes from reporting. By keeping the datasets clean, you can build a consolidated financial dashboard that pulls key figures from both your AP and AR databases, giving you a high-level overview without compromising the integrity of the source data.

This disciplined separation prevents operational confusion and provides a crystal-clear financial picture, making it easier to manage budgets, forecast revenue, and maintain healthy business operations.

9. Vendor Portal and Automated Receipt Integration

For businesses managing a high volume of supplier invoices, manually processing each one is a significant bottleneck. This method shifts the responsibility from receiving and entering data to automatically pulling it from vendor-provided portals or through direct API integrations. It removes the need to monitor email inboxes for invoices, as they are ingested directly into a central system. This approach is the best way to organize invoices for organizations looking to minimize manual touchpoints and reduce human error.

Enterprises often use this for high-spend suppliers through platforms like Coupa or Ariba, where invoices are transmitted electronically. For small businesses, this can mean using a vendor's specific online portal to access billing history or connecting accounting software to supplier systems. The core idea is to let technology fetch the data, ensuring accuracy and consistency from the source.

Implementation Steps

Setting up this automated flow requires initial configuration with key suppliers and establishing clear internal processes for managing these connections.

- Prioritize Connections: Start with your top-spend vendors. Identify which ones offer a customer portal or API access for billing and focus your integration efforts there first.

- Establish a Fallback: For vendors who cannot integrate, maintain a clear email forwarding rule (like the one discussed in item #8) as a reliable backup system.

- Map Data Fields: When connecting a system, map the vendor’s invoice fields (e.g.,

invoice_number,total_amount) to your own internal database properties in Notion or your accounting software to ensure data consistency. - Monitor and Reconcile: Regularly check the health of your integrations. Create a routine to reconcile pulled invoices against statements of account to catch any discrepancies or failed syncs early.

By focusing on automated ingestion from vendor portals, you fundamentally change your accounts payable workflow. Instead of being reactive to incoming documents, you proactively pull verified data directly from the source, which drastically improves accuracy and processing speed. This is a critical step in building a scalable financial operation.

This method is particularly effective for businesses with established supplier relationships and a predictable invoicing cycle. To see how this concept extends to centralizing all incoming documents, learn more about how NotionSender can capture emails and their attachments directly into your workspace.

10. Project-Linked Invoice Organization

For service-based businesses where profitability is measured project by project, linking invoices directly to their corresponding work scope is essential. Instead of a general chronological or alphabetical system, this approach organizes financial documents as integral parts of each project's lifecycle. This method provides immediate clarity on project-specific revenue and expenses, turning invoice management into a powerful tool for financial analysis and project oversight.

Consulting firms and creative agencies find this method indispensable for tracking billable hours and expenses against project budgets. Similarly, construction companies can link supplier and subcontractor invoices to specific project phases, ensuring costs are accurately allocated. The best way to organize invoices with this method is to treat each document as a financial data point that directly informs the health and profitability of an individual project.

Implementation Steps

To get started, establish a central repository for your projects, such as a dedicated database in Notion or a project management tool. This becomes the anchor point for all related financial documents.

- Project Codes: Implement a consistent project code convention (e.g.,

CLI-YYYY-001for Client-Year-Project Number). Apply this code to all related invoice file names and metadata for easy searching and filtering. - Database Relations: If using a tool like Notion, create a "Projects" database and an "Invoices" database. Use a

Relationproperty to link each invoice to its specific project. - Budget Tracking: In your Projects database, add

Rollupproperties to automatically sum theAmountfrom all linked invoices. This creates a real-time view of actual spending versus the planned budget.

By building a project dashboard, you can gain a high-level view of your entire portfolio's financial status. Create a view that filters for projects where the sum of invoiced amounts is approaching or has exceeded the budget, allowing for proactive financial management and client communication.

This approach excels by directly connecting financial data to operational activities, providing a granular understanding of where your business is most and least profitable. For more on structuring client work, see how to build an effective project management dashboard.

Top 10 Invoice Organization Methods Comparison

| Method | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes ⭐ / 📊 | Ideal Use Cases 💡 | Key Advantages |

|---|---|---|---|---|---|

| Digital Database Organization with Notion | Medium 🔄 — initial setup, relations, formulas | Low–Medium ⚡ — Notion subscription + setup time | Centralized retrieval, scalable record linking ⭐⭐⭐⭐ / 📊 moderate automation | Freelancers, small agencies managing projects & invoices | Central single source of truth; flexible relations; scalable |

| Email-to-Database Automation via NotionSender | Low–Medium 🔄 — email routing and template setup | Low ⚡ — NotionSender subscription, email discipline | Automated capture reduces manual entry and errors ⭐⭐⭐⭐ / 📊 high time savings | Busy professionals, PMs, freelancers needing auto-capture | Eliminates manual entry; real-time sync; attachment storage |

| Chronological Filing System | Low 🔄 — simple folder/date structure | Low ⚡ — minimal tools or cloud folders | Easy date-based retrieval; limited analysis ⭐⭐ / 📊 low analytics | Solo freelancers, very small businesses with low volume | Simple, intuitive, audit-friendly for time-based searches |

| Client-Based Organization Method | Low–Medium 🔄 — folder naming or DB relations | Low ⚡ — naming conventions and upkeep | Quick client-centric lookup and per-client reporting ⭐⭐⭐ / 📊 moderate | Design agencies, consultancies tracking client accounts | Groups all client history; simplifies client reporting |

| Category and Status-Based Organization | Medium–High 🔄 — taxonomy, views, workflows | Medium ⚡ — taxonomy design, training, maintenance | Multi-dimensional filtering and strong reporting ⭐⭐⭐⭐ / 📊 high | Agencies, companies with complex departments/projects | Highly customizable; supports automation and detailed analysis |

| OCR and Smart Data Extraction | Medium 🔄 — OCR integration and templates | Medium–High ⚡ — OCR service costs, QA/training | Near-elimination of manual entry; fast, accurate extraction ⭐⭐⭐⭐⭐ / 📊 very high | High-volume invoicing, teams seeking full automation | Accurate field extraction; scales well; reduces errors |

| Payment Terms and Aging Analysis Tracking | Medium 🔄 — formulas, alerts, dashboards | Medium ⚡ — data upkeep, automation rules | Improved cash flow, delinquency detection, DPO insights ⭐⭐⭐⭐ / 📊 high financial impact | Finance teams, B2B firms managing payables/receivables | Proactive collections; supports financial planning |

| Expense vs. Revenue Separation | Medium 🔄 — separate DBs/workflows & controls | Medium ⚡ — policy enforcement, possible duplicated fields | Clear AP vs AR reporting; audit alignment ⭐⭐⭐ / 📊 moderate-high | Accounting departments, professional services with AR/AP teams | Aligns with accounting practice; simplifies reporting and roles |

| Vendor Portal and Automated Receipt Integration | High 🔄 — API/integration and vendor onboarding | High ⚡ — engineering effort, vendor cooperation | Real-time standardized invoices and reduced email reliance ⭐⭐⭐⭐ / 📊 high | Large enterprises, companies with key suppliers | Consistent formats; real-time visibility; fewer manual steps |

| Project-Linked Invoice Organization | Medium 🔄 — project relations, rollups, coding | Medium ⚡ — project setup, dashboards, upkeep | Accurate project costing and profitability analysis ⭐⭐⭐⭐ / 📊 high for project finance | Project-based businesses: consultancies, construction, agencies | Links invoices to deliverables; supports budget vs actuals |

Building Your Perfect Invoice System

Navigating the world of invoicing can often feel like a disorganized scramble, a constant reaction to incoming documents and outgoing payments. Throughout this guide, we've explored ten distinct methods designed to shift that dynamic from reactive chaos to proactive control. The central theme is clear: the best way to organize invoices isn’t about finding a single, magic-bullet solution. It's about designing a bespoke system that fits the unique contours of your business operations.

A truly effective system is a composite, blending the structured logic of one method with the flexibility of another. Imagine combining a Client-Based Organization framework with Category and Status-Based tagging. This creates a powerful, multi-dimensional view where you can instantly see all invoices for "Client ABC," then filter them to show only those marked "Overdue" or categorized under "Q3 Marketing Campaign." This level of detailed organization turns a simple filing cabinet, whether digital or physical, into a dynamic financial dashboard.

From Filing to Financial Insight

The core purpose of organizing invoices extends far beyond simple record-keeping for tax season. When implemented correctly, your system becomes a source of critical business intelligence. By diligently tracking payment terms and conducting aging analysis, you gain a real-time understanding of your cash flow. Separating expenses from revenue invoices within the same framework gives you a clear, immediate picture of your profitability on a per-project or per-client basis.

This transition from a passive archive to an active workflow is where the real value lies. Instead of just storing documents, you are building a database that answers important questions:

- Which clients consistently pay late?

- What was the total expense for the "Alpha Project"?

- How much revenue is currently outstanding and over 30 days past due?

Answering these questions quickly and accurately is fundamental to making smart, data-driven decisions that guide your business forward. A disorganized system hides these answers, while a well-built one brings them to the forefront.

Your Action Plan for Invoice Mastery

The path to an impeccable invoice management system doesn't require a complete overhaul overnight. The key is to start with small, deliberate actions that address your most significant challenges.

- Choose Your Foundation: Select one primary organizational method to act as your system's backbone. Will you organize by client, by project, or chronologically? Pick the one that most naturally aligns with how you think about your work.

- Establish Clear Rules: Define your naming convention (

YYYY-MM-DD_ClientName_Invoice#) and your status tags (Paid,Pending,Overdue,Disputed). Consistency is non-negotiable for a system to function properly. - Automate Your Entry Point: The single biggest bottleneck in any system is manual data entry. Implementing a tool like NotionSender to automatically capture invoices from your email and send them directly to a centralized Notion database eliminates this friction entirely. This step alone can save hours each week and ensure no invoice ever gets lost in a crowded inbox.

By taking these first steps, you begin building a scalable foundation. You move from a state of document management to one of information management. The ultimate goal is to create a system so seamless that it practically runs itself, freeing you to focus on the work that actually grows your business. An organized invoice system isn't just an administrative task; it's a strategic asset that provides clarity, control, and confidence in your financial operations.

Ready to eliminate manual invoice entry and build your central command center? NotionSender bridges the gap between your inbox and your database, making it the perfect first step in automating your workflow. Get started for free and see how simple it is to find the best way to organize invoices at NotionSender.